Noble Gold Investments Review – Lowest fees and Premiums

Noble Gold Investments is a top-rated gold IRA company based in Pasadena, California. They specialize in helping Americans save for retirement and safeguard their wealth by investing in precious metals like gold, silver, and platinum.

The founder of Noble Gold Investments is Collin Plume. He established the company in 2016 with the goal of helping more investors diversify their retirement portfolios by including stable, gold-backed accounts. Since its inception, Noble Gold has gained a strong reputation as a reliable gold IRA company.

Why Noble Gold is Your Trusted Partner for Precious Metals in Retirement Accounts.

Noble gold takes pride in offering a white-glove, all-inclusive service to retirement account owners who want to diversify their portfolios with gold and silver. Here’s why they stand out:

1 ) Safe and Tax-Efficient Gold Investment: Guide investors through the process of adding precious metals to their retirement accounts. Their goal is to make it safe, tax-efficient, and hassle-free.

2) Education and Fair Pricing: Noble gold believe in empowering their clients. That’s why they provide education about gold investments. Plus, unlike some other gold companies, Noble gold don’t play hardball with aggressive sales tactics. No sky-high commissions here! Instead, they focus on delivering excellent service at competitive rates.

3) Top Ratings and Recognition: Commitment to transparency and customer satisfaction has earned an A+ rating from the Better Business Bureau (BBB). Additionally, 4.9/5 star rating on Google Reviews reflects the positive experiences of clients.

4) Featured in Reputable Publications: They’re not just saying it; Noble gold has been recognized by top-tier publications like Forbes, Fox News, and Investopedia. When you choose Noble Gold, you’re in good company.

Why adding gold to your investment portfolio is often considered a prudent move:

1) Diversification and Stability: Gold acts as a diversification tool. When other assets like stocks, bonds, or mutual funds face volatility during economic downturns, gold tends to move in the opposite direction. It provides stability and acts as a hedge against market turbulence.

2) Inverse Relationship with the Dollar: Historically, gold has moved inversely to the value of the US dollar. When the dollar weakens, gold tends to rise. As the dollar is the world’s primary reserve currency, this relationship is crucial.

3) Preservation of Wealth: Gold has maintained its value over centuries. Unlike paper currencies, which can be devalued by central banks, gold remains relatively stable. Investors buy gold as a way to preserve their wealth.

4) Inflation Hedge: During periods of inflation, the purchasing power of paper money decreases. Gold, on the other hand, tends to retain its value. Holding gold can act as a hedge against rising prices.

5) Geopolitical Uncertainty: Global events, such as geopolitical tensions or economic crises, can impact financial markets. Investors turn to gold as a safe-haven asset during uncertain times.

6) Central Bank Reserves: Central banks worldwide hold gold reserves as part of their foreign exchange reserves. This practice provides stability and confidence in a country’s currency.

7) Limited Supply: Gold is a finite resource. Its scarcity contributes to its value. Unlike paper money, which can be printed endlessly, gold supply remains relatively constant.

8) Psychological Appeal: Gold has cultural and psychological significance. People associate it with wealth, luxury, and stability. This perception adds to its allure.

Remember that individual circumstances vary. While gold offers benefits, it’s essential to assess your risk tolerance, investment goals, and time horizon. Consult with a financial advisor to determine the right allocation of gold within your portfolio.

What kind of gold do I need to buy?

When it comes to buying gold, it’s crucial to make informed decisions. Here’s what you need to know :

1) Quality Matters: At Noble, they prioritize high-purity gold. Noble gold investments sell IRS-approved bullion coins and bars—the gold standard (pun intended). These are recognized globally and maintain their value.

2) Beware of Collectibles: Some gold companies push collectible or premium coins. While these may seem enticing, they often come with hefty profit margins. Stick to the basics: pure bullion. Click here to learn more about Gold IRA scams.

3) “Most Gold for Your Buck”: The philosophy is simple. Noble gold want to give their clients the best value. By focusing on high-purity bullion, they ensure you get the most gold for your investment.

Conclusion

Noble Gold investments is a reputable company specializing in precious metals, particularly gold and silver. Noble Gold focuses on high-purity, IRS-approved bullion coins and bars. They prioritize quality over collectibles, ensuring that investors receive recognized assets. Unlike some gold companies that push premium coins with hefty commissions, Noble Gold aims to give clients “the most gold for your buck.” Their transparent pricing and commitment to fair deals set them apart. That’s why they have the lowest prices on bullion. With an A+ rating from the Better Business Bureau (BBB) and a strong 4.9/5 star rating on Google Reviews, Noble Gold has earned the trust of its clients.

In summary, if you’re considering gold investments, Noble Gold is a reliable choice. Request their Gold IRA kit to explore your options! Noble Gold’s Gold IRA kit provides essential details about investing in gold for your retirement. It covers the process, benefits, and how to get started.The kit is customized to your needs. Whether you’re a seasoned investor or new to gold, Noble Gold ensures you have the right information.

Noble Gold Investments- Gold IRA Accounts:

1) IRA Custodian Partner: Equity Trust

2) Storage Locations: multiple locations. Exclusive Storage storage available. Canada storage also available.

3) Annual Fees: Admin & maintenance: $100; Storage: $150 for segregated and $100 for non-segregated (commingled).

4) Storage type: segregated or commingled both available.

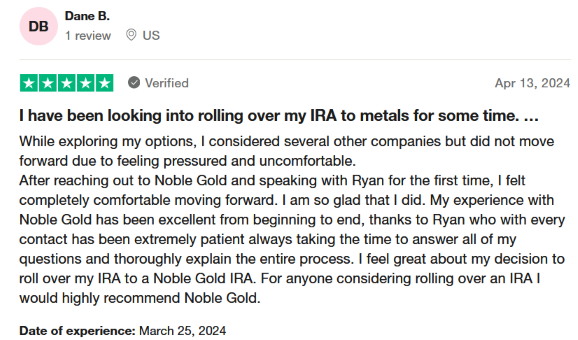

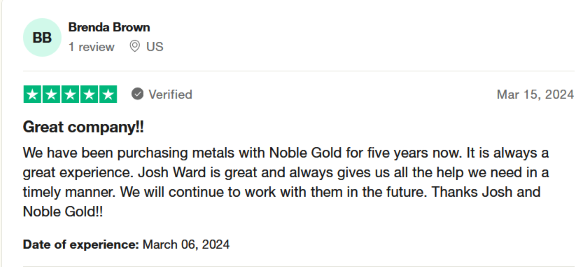

(Review posted on Trustpilot)

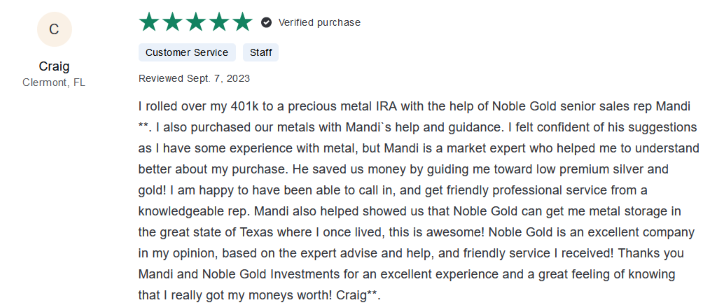

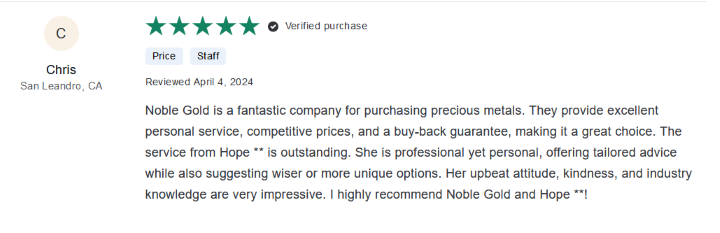

(Review posted on ConsumerAffairs)

Top Reasons to Invest in Noble Gold Investments

- A+ Rated by the BBB

- 4.9/5 stars on Google Reviews

- Noble Was Featured on Forbes, Business Insider, Fox News, Investopedia, AOL, MSN, Yahoo.

- Lowest Fees on Bullion

- All-in-One Gold IRA Company

- Exclusive Texas Storage Vault

- Focus on Education & Guidance

- Non-Pushy and Non-Aggressive Sales Team

- No Collectible Coins. Strictly Bullion.

- White Glove Service for Retirement Accounts Owners.

- Provides Free Gold IRA Guide & Educational Materials

Click Here To Request Noble Gold Free Gold IRA Kit

No-Obligation : Requesting the kit doesn’t commit you to anything. It’s an opportunity to explore gold as part of your retirement strategy. Remember, knowledge is power. Request your Gold IRA kit from Noble Gold today and make informed decisions for your financial future!