What is the Stock Market ?

Generally speaking the Stock Market refers to equities where actually stocks and derivatives are traded. In the U.S.A. we think the Stock Market is New York City. In fact there are major Stock Markets in Hong Kong, Hamburg, London, Paris, Canada, Japan and others that influence one another and impact the world Stock Market.

The New York Stock Exchange may have stocks listed that are listed on other major Stock Markets. A company headquartered in Amsterdam may be listed on multiple stock exchanges. Many foreign organized companies are listed on the New York Stock Exchange. There is a tremendous value for foreign companies to be listed on an exchange in the U.S. The exposure and knowledge of a foreign company has a face on the New York Stock Market.

An example would be a China stock Baidu. These information and search technology company has grown in leaps and bounds since it was introduced on the New York Market. Sometimes all it takes is making a good impression to stock analysts and a good review by key people to give the foreign company a boost.

The reality of the Stock Market today is its world wide integration of investors, companies and alliances that create an unprecedented dynamic. Thus far this United Nations of the financial markets has produced an unspoken treaty of like minds. The main objective is to create a win-win scenario for all of the world players in the Stock Market.

Any investor wherever located may hold a substantial stake in any given equity no matter where the equity is traded. The Stock Market is a very large private club that anyone can join with the only admission ticket is the price of a single share of stock.

Most people are aware of American companies utilizing off shore manufacturing of their products. It may be not as well known that some traditional American brand companies are owned by foreign companies. Other American brand companies have a significant multi-national presence with significant stock ownership by foreign banks and investors.

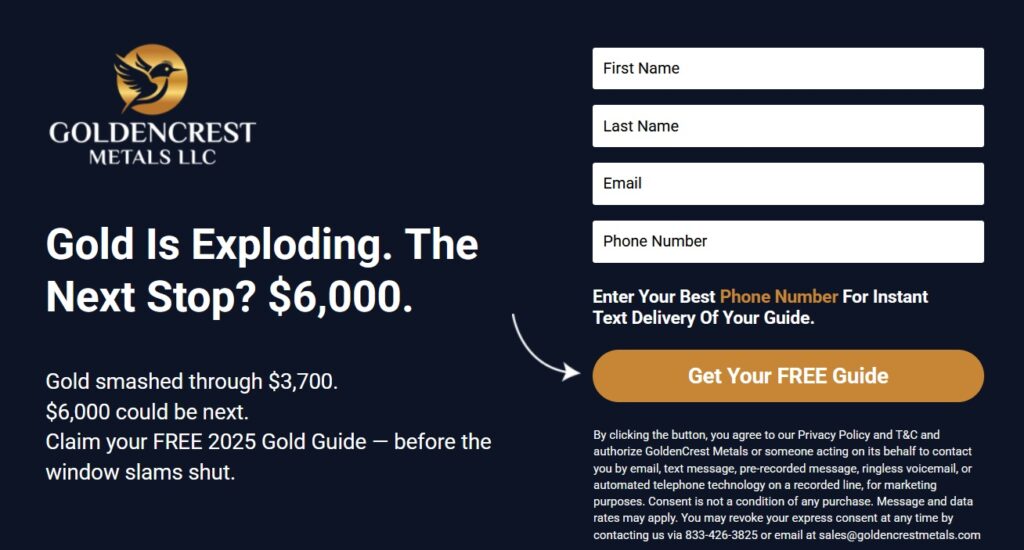

The term equity should be broadly interpreted. There are equities that involve the manufacturing of products and goods, but a product can be intellectual or an entity like insurance. Banks are equities and financial brokers are all traded on the various exchanges. An investor may own gold stocks, mining companies and equities that package these equities into a corporate entity. The only limitation is that if the investor is interested in owning the commodity or trading in the futures market the Chicago Mercantile or other commodities exchanges is the investing tool.

In other words you may own a bank as an equity who may have bonds and other commercial paper that may trade on the commodities exchanges, but you can’ t buy a commodity as a stock. If you want a commodity like wheat, currency, corn, gold, silver or the like you need to look to the commodities exchange.

In the United States the New York Stock Market is comprised of the NASDAQ, NYSE and the newly created combination of the NYSE Group with Euronext in April, 2007. The Euronext holding company is a phenomenal synergy between Paris and the NYSE whose history goes back to 1792.

The Euronext is a combination of derivatives, currency and equities to name a sample of products. There are other exchanges that include the AMEX. There are listing requirements for each of the exchanges. The Stock Market is basically a place where buyers and seller of a piece of a company come together and in the process the company hopefully raises some cash or other value.